Mortgage Rates Plummet to Lowest Level in 15 Months

Ian Waudby

Date: 27 Sep 2024

Read: 3 min

Last week, the European Central Bank (ECB) made its second rate cut, lowering the deposit rate to 3.5%, the lowest since July 2023. This move puts the ECB ahead of both the Federal Reserve and the Bank of England, which have each made only one rate cut, with the Fed implementing its first just this week.

Mortgage rates began falling after the ECB’s initial rate cut in June, as highlighted in our latest European Lifestyle Report. The second cut indicates further mortgage rate reductions are likely, which is particularly positive for the 20% of EU households with variable-rate mortgages.

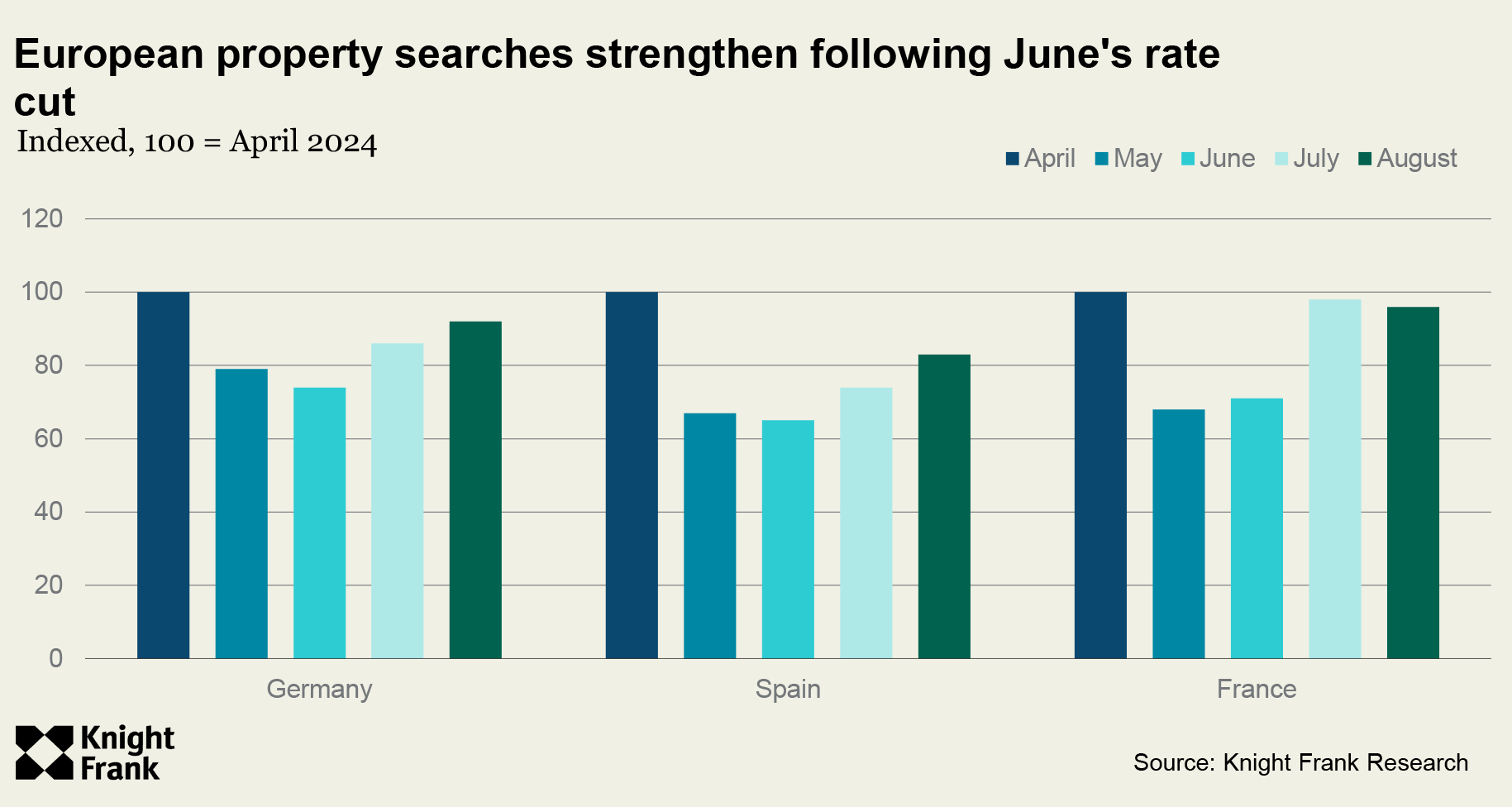

In France and Italy, average mortgage rates have decreased to 3.41% and 3.44%, down from their previous peaks of 3.60% and 4.50%, respectively, during the last tightening cycle. This trend has bolstered buyer confidence, with property searches for key European markets, as reported by Knight Frank, rising 29% since the ECB’s first rate cut on June 6th.

Resourses: www.knightfrank.com

In Spain, variable-rate mortgage rates may soon decline as the one-year Euribor, the key indicator used to calculate mortgage rates, currently stands at 3.503%. This presents a favorable situation for banking customers, who are benefiting from falling mortgage rates alongside rising deposit rates.

Ahead of next month’s European Central Bank (ECB) meeting, mortgage rates continue to ease, while savers see gains from increasing deposit rates. According to data from the Central Bank, the average interest rate on new mortgage agreements fell to 4.11% by the end of June—a six basis-point drop from the previous month, and the lowest rate in 10 months, following a peak in March.

In Ireland, banking customers are similarly benefiting from this trend. While mortgage rates are declining, deposit rates have risen to 2.75%, a 15-year high, though still below the eurozone average of 3.03%. “Irish households currently hold over €150bn in deposits, but much of it remains in accounts with little to no interest,” said Daragh Cassidy, head of communications at comparison site Bonkers. However, Cassidy noted that this favorable environment might be short-lived, as the ECB is expected to implement at least one more rate cut this year. While this will likely reduce mortgage rates further, it will also exert downward pressure on deposit rates.

When Will UK Interest Rates Fall Again?

The Bank of England has held interest rates steady at 5%, though another rate cut is anticipated later this year.

Interest rates directly impact mortgage, credit card, and savings rates for millions across the UK. While the first rate reduction in over four years occurred in August, borrowing costs remain elevated

The ECB is scheduled to meet in September to review its interest rate strategy, but an unexpected rise in eurozone inflation and wage growth in Germany, the bloc’s largest economy, has cast doubt on the likelihood of an immediate rate cut.

In Spain, prospective homebuyers are also contending with a chronic housing shortage, which has been driving up prices.

The cost of new properties is primarily influenced by development costs—construction expenses and fees are similar across Spain, but land costs are the main variable. In the coastal town of Ayamonte, located in the Huelva region, buyers have found some of the lowest land prices in the country, offering budget-friendly opportunities. Now may be the ideal time to act.

Discover a wealth of properties in Ayamonte!